[ad_1]

Ten Member States at the moment enable the usage of the time period “probiotics” on product labels, however the lack of harmonization is a trigger for ongoing concern, together with the shortage of an EFSA well being declare for “probiotics”.

As reported recently by NutraIngredients, the European Ombudsman just lately introduced it had discovered no maladministration by the European Fee in the way it addressed issues about its stance on probiotic meals and dietary supplements being systematically categorized as well being claims primarily based on a non-binding 2007 steerage.

“Establishing a extra constant and unified regulatory framework throughout Europe is important in offering authorized readability, strengthening shopper safety and permitting for continued innovation within the meals sector,” mentioned George Paraskevakos, govt director of the Worldwide Probiotics Affiliation (IPA).

“Merchandise with probiotics are extensively utilized by shoppers globally, and the timing for this might have served as a terrific event to put some basis in the direction of regulatory harmonization to trade, regulators and shoppers.“

The market

Previous to 2009, Europe was the primary marketplace for probiotics, however now ranks third after China and the US. In Europe, the retail worth of probiotics, (bitter milk merchandise, yogurts and dairy-based drinks, meals dietary supplements), was round € 10 Billion in 2023, in line with IPA Europe.

The market is dominated by 5 counties—Germany, France, the U.Okay., Italy and Spain, in line with IPA Europe. These symbolize roughly 60% of the European market of probiotic dietary supplements.

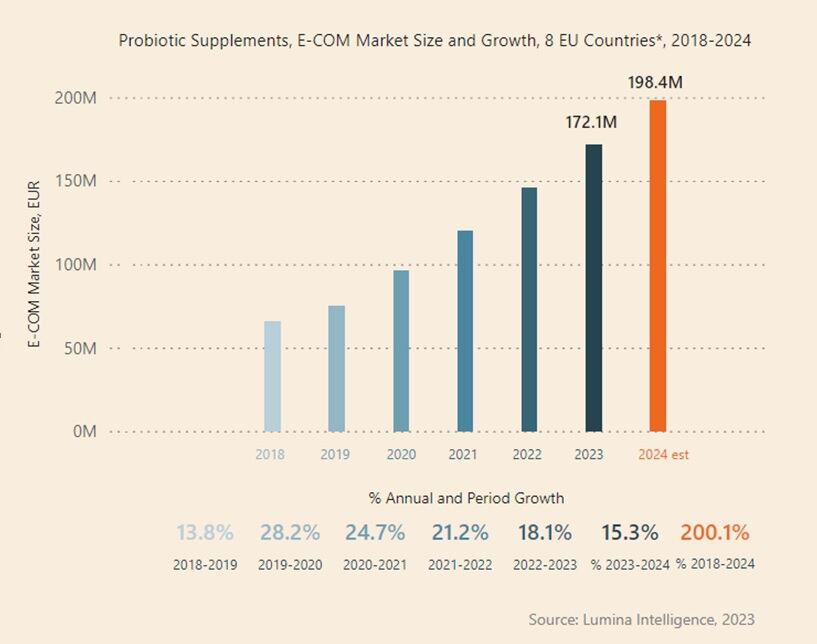

Whereas on-line gross sales of probiotic dietary supplements in 8 EU international locations* surged throughout the pandemic with development charges of 25% reported in 2020, knowledge from Lumina Intelligence reveals that this has slowed. Regardless of the post-pandemic readjustment, Lumina knowledge nonetheless estimated 15.3% YoY development in 2024 to yield gross sales of virtually €198 million (adjusted for inflation), and that was after 18% and 21% YoY development reported in 2022 and 2021, respectively.

Formulators and entrepreneurs additionally have to think about shopper understanding, and right here work nonetheless must be completed. For instance, a survey of 8,000 shoppers throughout eight European international locations commissioned by IPA–Europe and carried out by 3Gem** highlighted the influence of the restrictions round use of the time period and the extent to which shoppers really feel knowledgeable in regards to the helpful microorganisms. Certainly, the survey discovered that buyers in seven out of the eight international locations reported they didn’t really feel knowledgeable about probiotics contained in industrial merchandise.

Codecs

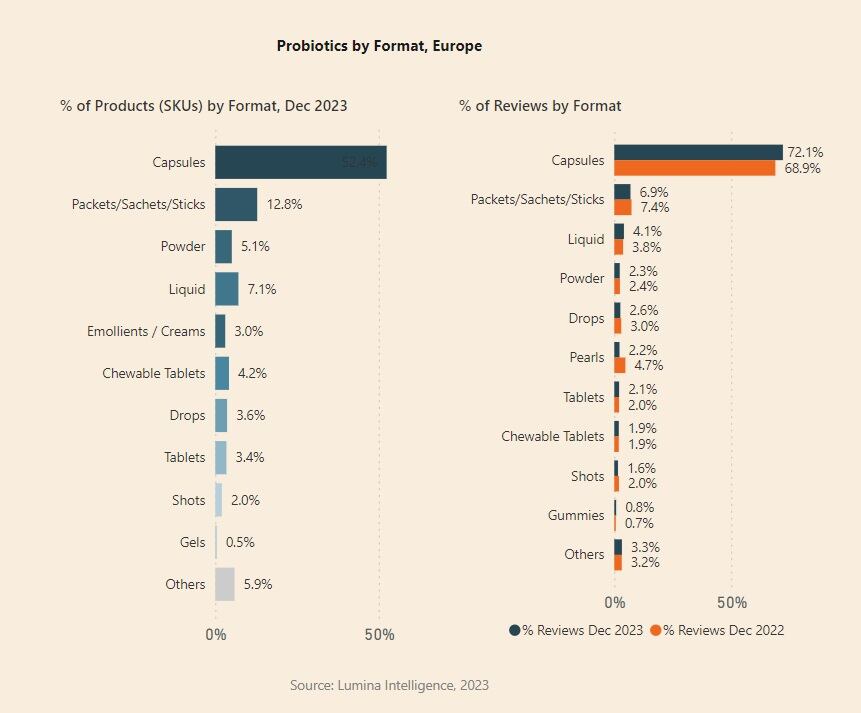

Capsules dominate with over 50% of the market (2023, Lumina Intelligence), with packets, sachets and sticks a distant second with 12.8%. Curiously, gummies and chewables are a tiny part of the European on-line market, representing lower than 5% of all SKUs.

The broader -biotics alternative…

Lumina additionally presents some insights into prebiotics and postbiotics within the on-line house.

Based on Lumina analysts in Sweden and Finland, the place consciousness and understanding of “probiotics” is comparatively excessive, post- and prebiotic merchandise are nonetheless much less well-known. Insights from Sweden revealed that “shoppers are prone to go for mixture merchandise akin to Husk model containing probiotics and prebiotic fibers.”

In Finland, “the marketplace for prebiotics and postbiotics is much less developed and there may be lack of merchandise”, mentioned an analyst. Once more, “prebiotics are sometimes discovered together merchandise together with each pre- and probiotics”.

The image for postbiotics is difficult by the truth that the time period “postbiotic” is never used, being changed by different phrases such lysates, heat-killed strains, parabiotics, short-chain fatty acids, fermentates and plenty of extra.

Whereas the emergence of postbiotics creates additional challenges to the general sector as shoppers are uncovered to yet one more -biotics time period, postbiotics lend themselves to larger inclusion in gummies and chewables, in comparison with probiotics, which want to stay viable and subsequently spore-forming strains or encapsulation strategies are sometimes employed.

* EU international locations tracked by Lumina: Belgium, Germany, Spain, Finland, France, Italy, Poland, Sweden.

**The IPA-Europe, 3Gem survey targeted on Italy, Denmark, the Netherlands, Spain, Poland, Belgium, Germany and Sweden. Poland was the one nation the place extra shoppers felt knowledgeable than non-informed about probiotics.

[ad_2]

Source link

Leave a Reply